Calendar Put Spread

Calendar Put Spread - The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A put calendar spread consists of two put options with the same strike price but different expiration dates. Calendar spreads are also known as ‘time. Here is one way to capture opportunities created by volatility. What is a calendar put spread? A calendar spread is a strategy used in options and futures trading:

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A put calendar spread consists of two put options with the same strike price but different expiration dates. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Calendar spreads are also known as ‘time..

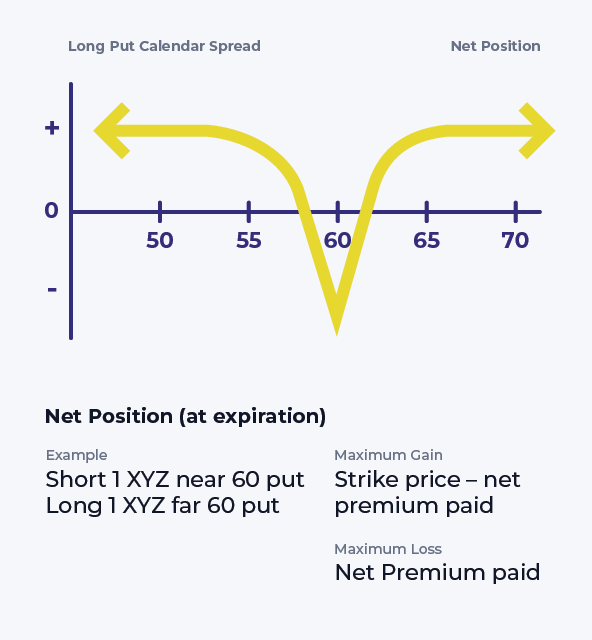

Long Put Calendar Spread (Put Horizontal) Options Strategy

A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A calendar spread is a strategy used in options and futures trading: A put calendar spread consists of two put options with the same strike price but different expiration dates. What is a calendar put spread? Calendar spreads are also known as ‘time.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A calendar spread is a strategy used in options and futures trading: A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited.

Calendar Put Spread — Options Edge India Dictionary

A put calendar spread consists of two put options with the same strike price but different expiration dates. A calendar spread is a strategy used in options and futures trading: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. What is a calendar.

Long Calendar Spread with Puts Strategy With Example

A put calendar spread consists of two put options with the same strike price but different expiration dates. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A calendar spread is a strategy used in options and futures trading: What is a calendar put spread? Calendar spreads are also known as ‘time.

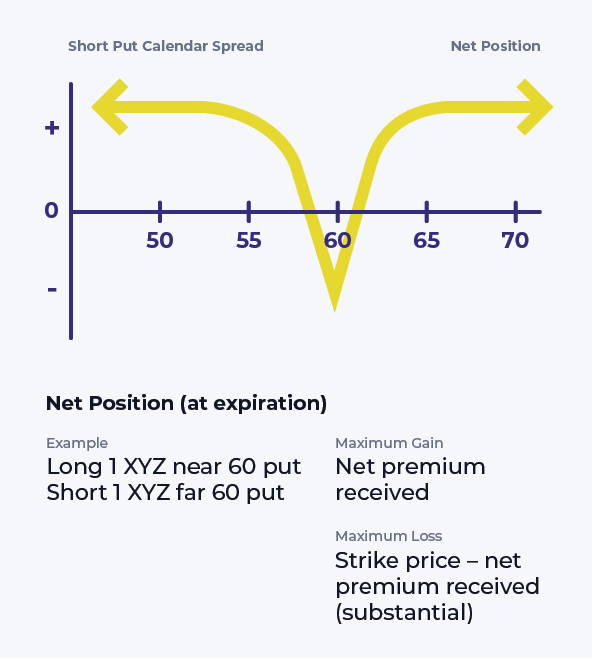

Short Calendar Put Spread Staci Elladine

A calendar spread is a strategy used in options and futures trading: A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. Calendar spreads are also known as ‘time. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock.

Calendar Put Spread Options Edge

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Here is one way to capture opportunities created by volatility. Calendar spreads are also known as ‘time. A calendar spread is a strategy used in.

Calendar Call Spread Option Strategy Heida Kristan

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Here is one way to capture opportunities created by volatility. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. What is a calendar put spread? A.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Here is one way to capture opportunities created by volatility. A put calendar spread consists of two put options with the same strike price but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A neutral to mildly bearish/bullish strategy.

Short Put Calendar Spread Options Strategy

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Calendar spreads are also known as ‘time. A calendar spread is a strategy used in options and futures trading: A neutral to mildly bearish/bullish strategy.

What is a calendar put spread? A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A calendar spread is a strategy used in options and futures trading: Here is one way to capture opportunities created by volatility. A put calendar spread consists of two put options with the same strike price but different expiration dates. Calendar spreads are also known as ‘time. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later.

Here Is One Way To Capture Opportunities Created By Volatility.

A put calendar spread consists of two put options with the same strike price but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A calendar spread is a strategy used in options and futures trading: The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction.

What Is A Calendar Put Spread?

A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. Calendar spreads are also known as ‘time.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)